Provide the ultimate tool for expressing directional views, hedging portfolio risk, or capitalizing on volatility—delivering institutional-grade exposure with unmatched flexibility.

Positions settle directly to cash at expiration without the need to deliver or receive unwanted shares

Choose from A.M or P.M, standard, weekly, and daily expirations to align precisely with your market outlook.

Each contract controls 100 times the index value (e.g., SPX at 4,000 means $400,000 notional value).

Options can only be exercised at expiration, providing certainty and eliminating early assignment risk.

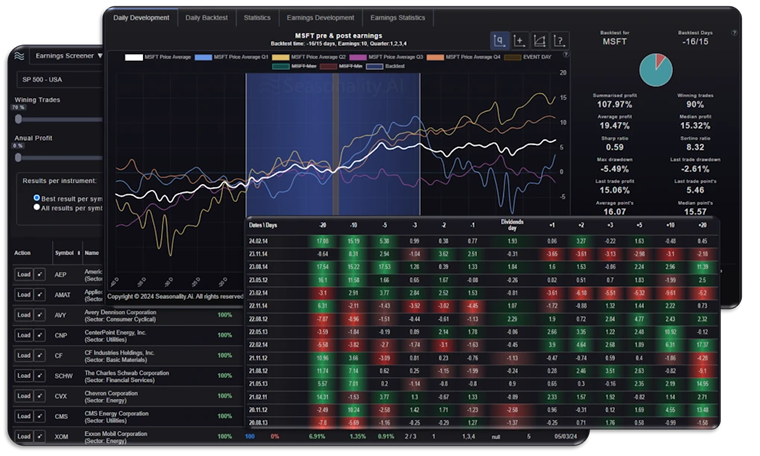

Follow SPX market direction at a glance and pair it with volatility to understand risk, hedging activity, and broader equity momentum—then switch timeframes to compare trend behavior.

ViewSuccessfully trading SPX options requires a deep understanding of the broader market environment, as the S&P 500 index is influenced by numerous factors.

Effective Risk Management

Effective Risk Management Provide a Trading Experience

Provide a Trading Experience Understanding SPX Contract Specifics

Understanding SPX Contract Specifics Empowering Traders Worldwide

Empowering Traders Worldwide

Hey there! Got questions? We've got answers. Check out our FAQ page for all the deets. Still not satisfied? Hit us up.

Online trading’s primary advantages are that it allows you to manage your trades at your convenience.

You don’t need to worry, the interface is user-friendly. Anyone can use it smoothly. Our user manual will help you to solve your problem.

Online trading’s primary advantages are that it allows you to manage your trades at your convenience.

Online trading’s primary advantages are that it allows you to manage your trades at your convenience.

Online trading’s primary advantages are that it allows you to manage your trades at your convenience.

Online trading’s primary advantages are that it allows you to manage your trades at your convenience.